Arattai, the “Made-in-India” messaging application developed by Zoho Corporation, has garnered significant attention in late 2025, reaching the number one position on India’s App Store and experiencing a 100-fold increase in daily sign-ups. Despite this remarkable surge and government endorsements, multiple systemic barriers prevent Arattai from displacing WhatsApp as India’s dominant messaging platform. The primary obstacles include WhatsApp’s entrenched network effects, established ecosystem integration, infrastructure maturity, feature completeness, and the fundamental challenge of overcoming user inertia in a market where switching costs extend far beyond individual preferences to entire social and business networks.

Comparison between WhatsApp and Arattai highlighting the competition between the global and Made-in-India messaging apps

The Network Effects Fortress

WhatsApp’s Unassailable User Base Advantage

WhatsApp’s dominance in India stems fundamentally from its massive user base of 535.8 million monthly active users, representing a 97% market penetration rate. This creates what economists call network effects—where the value of a platform increases exponentially with each additional user. The Competition Commission of India has explicitly recognized that WhatsApp’s “reach and daily engagement levels, reinforced by powerful network effects, ensure that users remain locked into the service”.

Research on messaging app switching behavior reveals that network effects create the strongest barrier to platform migration. For Arattai to succeed, it would need not just individual users to switch, but entire social networks to migrate simultaneously—an extraordinarily difficult coordination problem. When users consider switching messaging platforms, they must convince their entire contact network to follow, as messaging apps only provide value when both sender and recipient use the same platform.

The Coordination Challenge

Historical analysis of messaging app competition demonstrates this challenge clearly. Even when superior alternatives emerge, established platforms maintain dominance through user lock-in effects. Telegram, despite offering better features in many areas, has achieved only 100 million users in India compared to WhatsApp’s 535 million, precisely because of these network effects. Signal, despite superior privacy features, has struggled with adoption barriers, with only 10% of Indian users having tried it compared to 37% for Telegram.

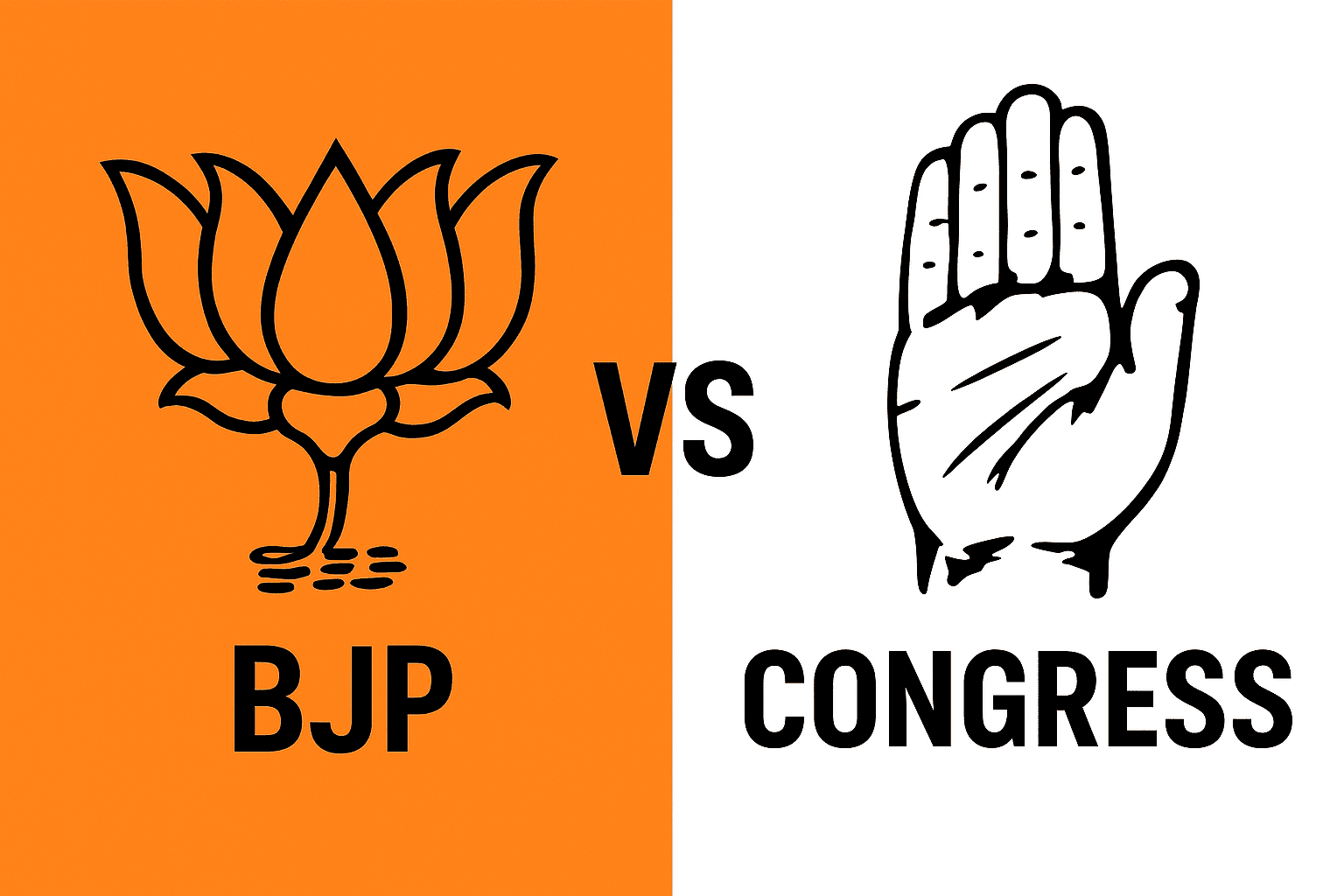

Feature comparison between Arattai and WhatsApp highlighting key differences

Infrastructure and Technical Maturity Gaps

Scalability and Reliability Challenges

Arattai’s recent surge has already exposed critical infrastructure limitations. The app experienced server overloads, user-reported lags, OTP delays, and call drops during its growth phase. Zoho admitted they were “working hard to expand servers to handle the sudden flood of downloads”. This highlights a fundamental challenge: building messaging infrastructure that can reliably serve hundreds of millions of users requires years of investment and optimization that WhatsApp has already completed.

WhatsApp processes over 100 billion messages daily globally and maintains 83% daily user engagement rates. Achieving this level of technical reliability requires sophisticated distributed systems architecture, global content delivery networks, and robust redundancy mechanisms. Messaging infrastructure scalability involves complex challenges including message queuing, database optimization, load balancing, and real-time synchronization across millions of concurrent users.

Security and Encryption Deficits

A critical technical gap is Arattai’s incomplete encryption implementation. While WhatsApp provides end-to-end encryption for all messages and calls, Arattai currently offers encryption only for voice and video calls, not text messages. This represents a significant security disadvantage, particularly as privacy concerns drive messaging app selection decisions.

The lack of text message encryption means Arattai cannot match WhatsApp’s security assurances—a crucial factor for users handling sensitive communications. This gap is particularly problematic given that privacy and security are among the primary reasons users consider switching messaging platforms.

Main barriers preventing users from switching from WhatsApp to alternatives like Arattai

Ecosystem Integration and Business Dependencies

WhatsApp’s Deep Business Integration

WhatsApp has evolved far beyond simple messaging into a comprehensive business communication platform. The WhatsApp Business ecosystem includes payment processing, customer service workflows, e-commerce integrations, and marketing automation. Over 50 million businesses worldwide use WhatsApp Business, generating $382 million in revenue with a global average revenue per user of $0.26.

This business integration creates powerful switching costs for organizations that have built their customer communication workflows around WhatsApp. Companies using WhatsApp for customer support, order processing, payment collection, and marketing campaigns face substantial disruption costs when considering alternatives.

Limited Business Feature Parity

Arattai’s business features remain rudimentary compared to WhatsApp’s comprehensive suite. While Arattai offers basic channels and content sharing, it lacks the sophisticated business tools that WhatsApp provides, including payment integration, catalog management, automated customer service flows, and extensive API integrations. For businesses already integrated into WhatsApp’s ecosystem, switching would require rebuilding entire communication infrastructures.

User Behavior and Switching Barriers

Psychological and Habitual Inertia

Research on mobile application switching behavior identifies multiple psychological barriers that prevent users from migrating platforms. Studies show that user inertia—the tendency to stick with familiar platforms—acts as a powerful deterrent to switching, even when alternatives offer superior features. WhatsApp benefits from over a decade of user habit formation, creating what researchers call “switching resistance” based on familiarity, muscle memory, and established usage patterns.

The push-pull-mooring framework used to analyze user switching behavior reveals that successful platform migration requires not just attractive alternatives (pull factors) and dissatisfaction with current platforms (push factors), but also overcoming mooring factors like habit, affective commitment, and perceived switching costs. Arattai faces the challenge that most WhatsApp users are not sufficiently dissatisfied to overcome these mooring factors.

Multi-Platform Complexity

Modern users typically employ multiple messaging apps simultaneously, with 90% of Chinese users and 60% of American users utilizing multiple messaging platforms. However, this creates fragmentation rather than replacement—users add Arattai as a supplementary platform rather than replacing WhatsApp entirely. The lack of interoperability between messaging apps means users cannot consolidate their communications, leading to platform multiplication rather than substitution.

Historical Precedents and Market Realities

Lessons from Failed Competitors

The messaging app landscape is littered with failed WhatsApp challengers, even those with significant advantages. Hike Messenger, despite being “Made in India” and achieving 100 million registered users with a $1.4 billion valuation, ultimately shut down in 2021 because it “was unable to compete” with established platforms. This demonstrates that patriotic appeal and feature innovation alone cannot overcome network effects and market dominance.

Similarly, despite strong privacy features and open-source development, alternatives like Signal have struggled to achieve mainstream adoption. Wire, founded by Skype co-founder Janus Friis with superior security features, remains relatively unknown due to low user numbers. These examples illustrate that technical superiority and founder credentials are insufficient to displace established messaging platforms.

The Scale Requirements

WhatsApp’s global infrastructure spans 180 countries with 60 language localizations. It maintains consistent performance across diverse network conditions, from high-speed broadband to 2G connections in rural areas. Replicating this infrastructure requires massive capital investment and technical expertise that few companies can match.

Building a messaging platform that can handle WhatsApp’s scale of 100 billion daily messages across 3.14 billion users requires infrastructure investments measured in billions of dollars over many years. This represents an enormous barrier to entry that even well-funded alternatives struggle to overcome.

Regulatory and Market Structure Considerations

Competition Commission Findings

India’s Competition Commission has formally recognized WhatsApp’s dominant market position, noting that the platform holds a 95% market share in over-the-top messaging services. The CCI concluded that due to network effects and user dependence, WhatsApp can function “mostly independently of market forces, due to the lack of feasible substitutes and the hesitation of users to switch”.

This regulatory recognition of WhatsApp’s dominance acknowledges the structural barriers preventing competitors from gaining market share. The CCI’s analysis emphasizes that WhatsApp’s position is reinforced by behavioral economics factors that make user switching extremely difficult.

Conclusion

While Arattai represents an admirable attempt to create a domestic alternative to WhatsApp with privacy-focused features and Indian cultural resonance, multiple interconnected barriers make replacement practically impossible. The combination of network effects requiring coordinated mass migration, infrastructure requirements demanding billions in investment, ecosystem integration creating business switching costs, psychological user inertia, and historical precedents of failed competitors creates an insurmountable competitive moat around WhatsApp.

Arattai may succeed in carving out a niche market among privacy-conscious users or as a supplementary messaging platform, but displacing WhatsApp as India’s primary messaging service would require overcoming barriers that have defeated numerous better-funded and more feature-rich competitors. The messaging app market demonstrates that first-mover advantages, when combined with network effects and ecosystem integration, create competitive positions that are extraordinarily difficult to displace, regardless of technical merit or patriotic appeal.

The current surge in Arattai downloads likely represents curiosity and supplementary adoption rather than wholesale switching, as evidenced by similar patterns with previous WhatsApp alternatives that generated initial excitement but failed to sustain meaningful market share growth. For Arattai to achieve sustainable success, it must focus on differentiated use cases and gradual market share growth rather than attempting direct WhatsApp replacement.